To review transactions to identify erroneous use tax assessment:

- Log in to UAccess Financials and log in.

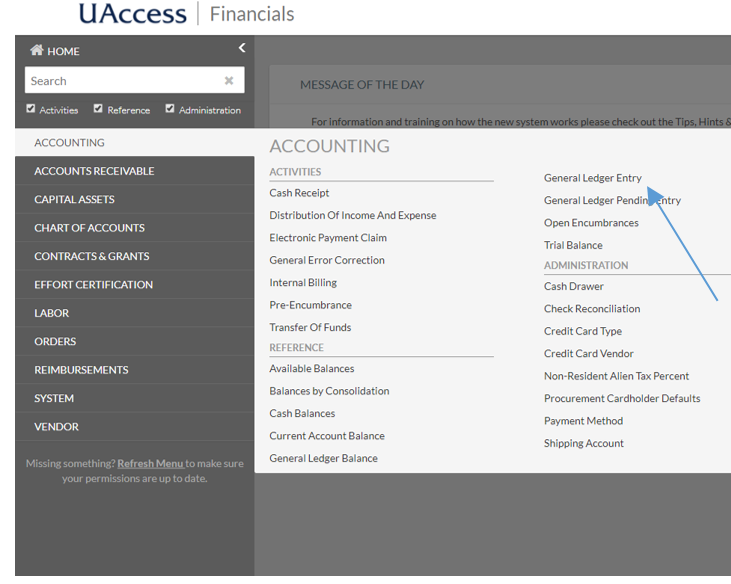

- Click on Accounting > General Ledger Entry

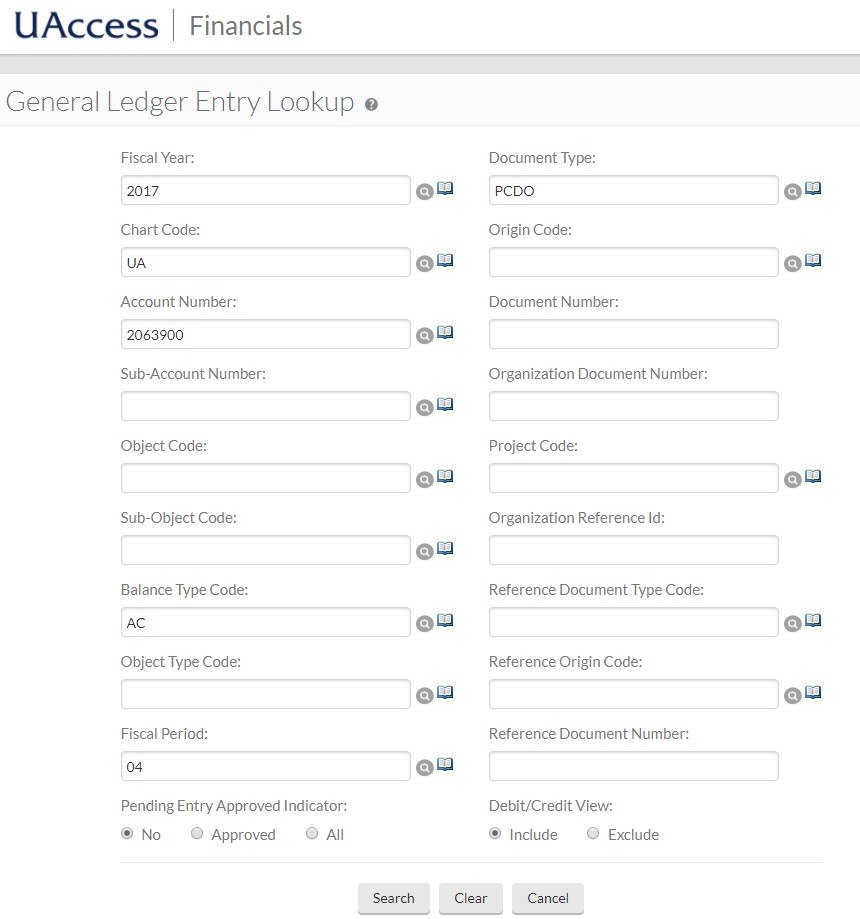

- Enter the Fiscal Year, Chart Code (UA), Account Number, Fiscal Period and Document type (PCDO)

- Object Code, Document Number, an asterisk (*) instead of a period number, and other fields can be completed to narrow or expand the search if needed

- Object Code, Document Number, an asterisk (*) instead of a period number, and other fields can be completed to narrow or expand the search if needed

- Click Search

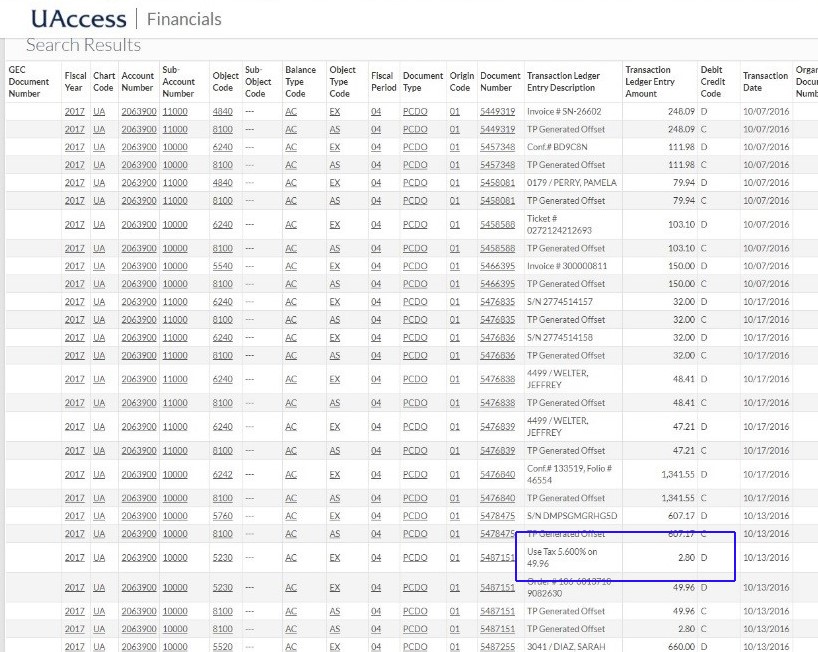

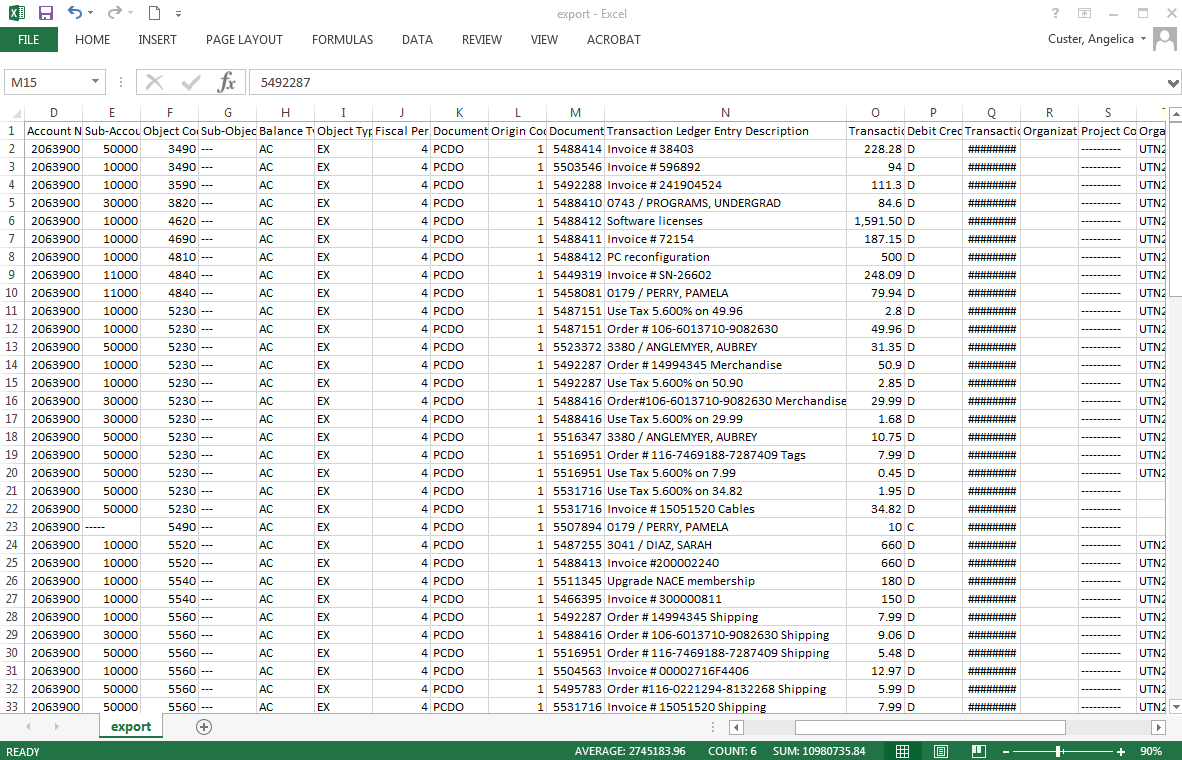

- Sort the results by Document Number by clicking the Document Number column label

- Review the data for transactions where use tax was charged (or not charged but should have been)

- Transactions where use tax was charged will include an additional line item with “Use Tax 5.600% on $$.$$” (where $$.$$ is the amount of the original expense) in the Transaction Ledger General Entry Description Line

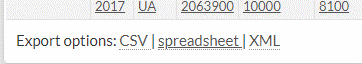

- The report can be exported for additional review or sorting of the data if needed

- Transactions where use tax was charged will include an additional line item with “Use Tax 5.600% on $$.$$” (where $$.$$ is the amount of the original expense) in the Transaction Ledger General Entry Description Line

- If use tax needs to be assessed or reversed, continue to create a document for an adjustment