Facilities and Administrative (F&A) costs represent the infrastructure and operations costs that support the research enterprise at the University of Arizona. Similar to the overhead costs of a business, F&A costs are real costs incurred in conducting and running the University's research program.

Calculating the costs for thousands of University projects would be an administrative burden. Therefore, the federal government allows us to use an average cost by function and charge a single rate. We, in turn, apply these same rates to non-government research programs.

Direct Costs vs F&A Costs

Direct Costs are funds used by the Principal Investigator to pay for the costs of conducting the research including:

- Salaries and benefits for researchers

- Award-specific supplies

- Award-specific equipment

- Travel to conferences

- Publication costs

F&A Costs are funds used to maintain the University's research infrastructure, including:

- Facilities maintenance

- Utilities

- Amortized cost of the research facility

- Department/school/college administrative costs

- Research support offices

- Proposal submission and approval

- Purchasing services

- Payroll services

- Invoicing services

- Accounting services

- Reporting services

- Human Resources

- Compliance (such as approval and monitoring of research involving human subjects, animals, or toxic chemicals)

Determining F&A Costs

The basic procedures for determining F&A costs are:

- Calculate Total Direct Costs (TDC) for all direct costs

- Calculate exemptions (capitalized equip, tuition, etc.)

- Deduct exemptions from TDC to determine the Modified Total Direct Costs (MTDC)

- Multiply the MTDC by the UA's current F&A rate to determine F&A costs

$150k TDC - $50k Exemptions = $100k MTDC

$100k MTDC x 53.5% F&A Rate = $53.5k F&A costs

$150k TDC + $53.5k F&A costs = $203.5k

F&A Rates Through FY20

| RES | INS | OSA | |

|---|---|---|---|

| On-campus | 53.5% | 50.0% | 47.0% |

| Off-campus | 26.0% | 26.0% | 26.0% |

F&A Cost Rate Calculation

F&A cost rates are based on the UA's actual operating costs. Using guidelines provided by the federal government, the U of A assesses its F&A cost on a regular basis. Once all the F&A costs are determined, the UA determines the portion of costs that are related to research (e.g. building costs for research space, sponsored project support, library and Human Resource cost pools, etc.). Every four to five years this information is reviewed by the federal government during F&A rate negotiations.

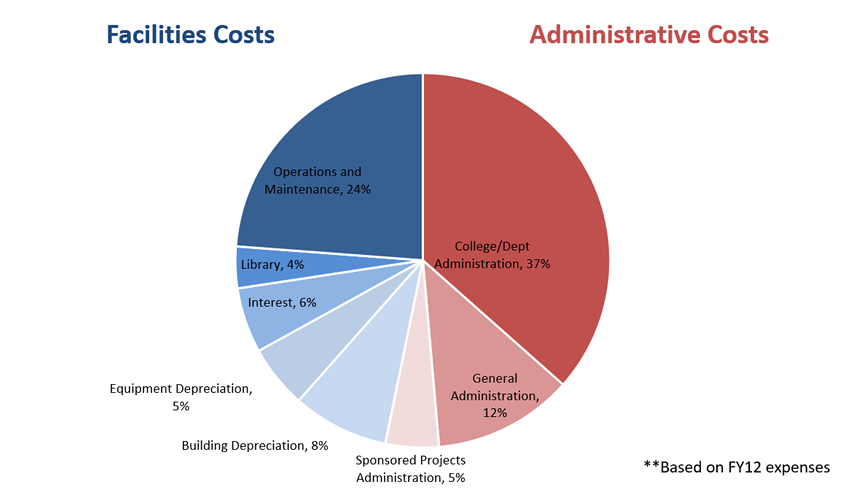

Breakdown of F&A Costs for On-Campus Research

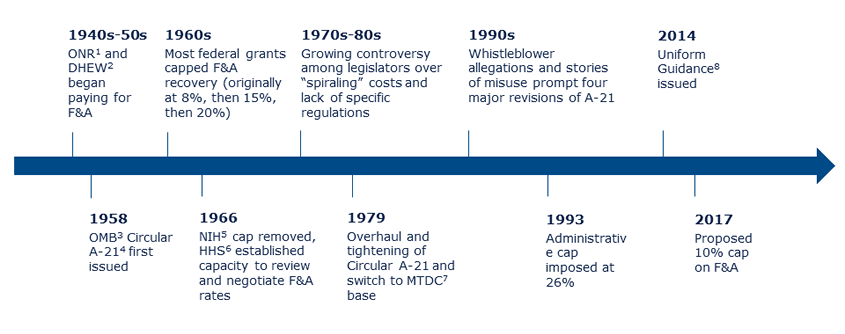

A Brief History of F&A

Evolution of F&A Policies: 1940 to Present

- Office of Naval Research

- Department of Health, Education, and Welfare

- Office of Management and Budget

- Cost Principles for Educational institutions

- National institutes of Health

- Department of Health and Human Services

- Modified Total Direct Costs (excludes equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each sub-award in excess of $25,000)

- Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards

The University extends its gratitude to Cornell University for providing these visuals